Read This Before You Take a Merchant Cash Advance (MCA)

On its face, a Merchant Cash Advance (MCA) may seem like a dream come true. For businesses desperate to plug a cash flow gap, MCAs are positioned as a quick-fix financial solution for businesses that lack credit and collateral. In reality, there’s much more to consider before committing yourself to this financial arrangement.

Four things to consider before you take a Merchant Cash Advance (MCA):

1. The Allure of Quick Cash

You may be lured by the promise of fast cash with minimal paperwork and hassle. The application process is straightforward, and the allure of quick funding may make it seem like the perfect solution for immediate financial needs.

2. Hidden Costs

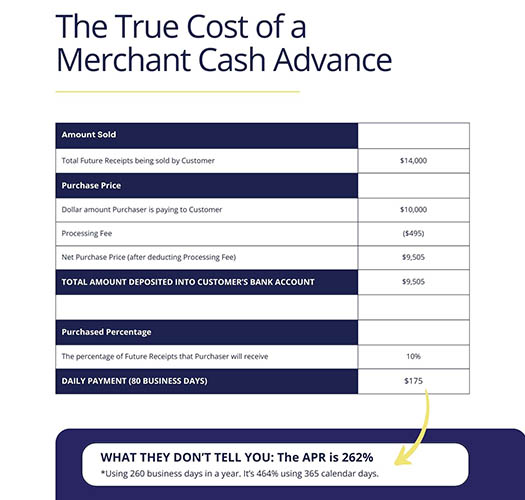

However, this initial convenience masks an impending storm. MCAs are notorious for their exorbitant fees and daily repayment structures. On their face, the daily payments seem manageable, but they quickly snowball. Instead of easing cash flow issues, the relentless withdrawals make it harder to cover operational expenses. It’s a vicious cycle of borrowing more money just to repay the initial loan.

3. The Vicious Cycle

MCA loans will blindside you with their hidden costs. Over time, it becomes evident that you will pay far more than you may initially anticipate. The daily financial strain could force you to make painful cutbacks in critical areas of your business. Employee layoffs, deferred maintenance, and reduced marketing efforts can put your business’s revenue, reputation, and customer base at risk.

4. A Lack of Full Disclosure

One of the biggest issues with MCAs is the lack of full disclosure, which allows unscrupulous lenders to prey on vulnerable small business owners. These lenders often exploit the desperation of business owners in need of quick capital, often leading to devastating financial consequences.

Lessons Learned

While MCAs might provide a temporary solution for business owners seeking quick capital, their hidden costs, relentless repayment schedules, and lack of regulation can lead to catastrophic consequences.

While the promise of quick cash can be incredibly enticing, especially when you’re facing immediate financial pressures, the long-term impact on your business can be disastrous. If you’re an entrepreneur considering an MCA and you have accounts receivable, we encourage you to talk to us first. Factoring is typically cheaper than an MCA; since it isn’t a loan, it doesn’t require interest payments. We’re also not concerned with your personal credit history.

Sky Business Credit is experienced in overcoming the challenges you face and we are committed to providing transparent, honest, and supportive financial solutions tailored to your needs. Contact us today to explore how factoring can help your business thrive without the hidden pitfalls of MCA loans.

Don't Wait to Get Paid. Factoring Helps Businesses Fast!

Factoring is a cash flow tool that can assist you with sales growth. It can provide you with immediate access to cash rather than having to wait 30, 45, or 60+ days for customer payments.

Sky Business Credit can boost the cash flow of almost any business that sells a product or service to another business. We have the same goal: to fund your business quickly and painlessly so your company can grow.

- Pay payroll on time

- Pay supplier and vendor payments on time

- Take advantage of quick pay discounts

- Pay taxes on time

- Pay bills on time

- Extend payment terms to customers that weren’t previously possible

- Fund business growth

- Credit and collections assistance (saves administrative costs)

- Buy new equipment

- Increase inventory

- New marketing initiatives

We can work fast. Most deals are funded within 2-4 days from receipt of a package and document signing. Get started today!

Get More Information

Please complete the form below. You will receive a response within 24 hours.

Sign up for our newsletter