What Makes Up a Good Invoice?

A good invoice is necessary for a few reasons:

- It’s a legally enforceable agreement between a business and its clients for services or products rendered and payment owed.

- It helps to ensure prompt payments.

- It helps businesses track sales and manage finances.

- It helps businesses maintain a strong professional image

An invoice is a legal document that can take many visual formats, but a good invoice includes three key elements:

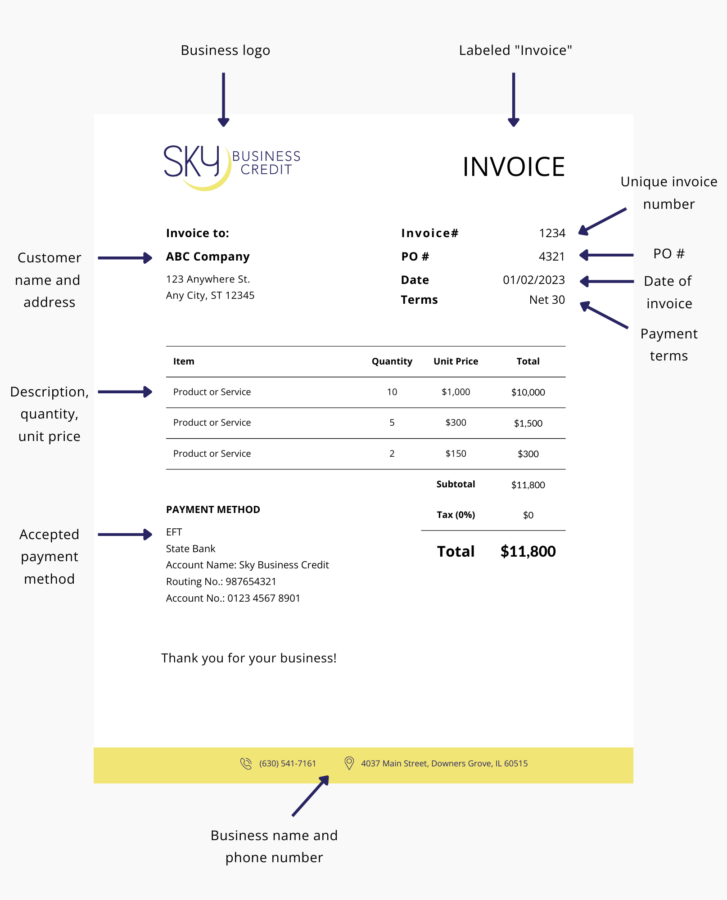

Business and Purchase Order Information

This includes your business name and address, contact details, logo (if applicable), customer’s name and address, the date of the invoice, a unique invoice number, and your customer’s PO#. Making this information readily available ensures accuracy and streamlines the invoicing process.

A Detailed Description of Products or Services

Clearly outline the products sold or services rendered in your invoice. Provide a detailed description of each item along with the quantity, unit price, and any applicable taxes. If there is more than one product or service, list them as separate line items and include the total amount due. If you’re transparent and straightforward in your invoice, you’ll minimize the possibility of payment disputes.

Payment Terms and Dates

Specific payment terms set clear expectations for your clients. Be sure to include the payment due date, accepted payment methods (e.g., ACH, credit card, remittance address, etc.), and any early payment discounts or late payment penalties. This will help ensure a smoother payment process and minimize misunderstandings.

Creating a well-structured and professional invoice is vital to a successful business. By including these key elements, you’ll facilitate timely payments and strengthen your client relationships, thereby helping you maintain a healthy cash flow.

An Example of a Good Invoice

Don't Wait to Get Paid. Factoring Helps Businesses Fast!

Factoring is a cash flow tool that can assist you with sales growth. It can provide you with immediate access to cash rather than having to wait 30, 45, or 60+ days for customer payments.

Sky Business Credit can boost the cash flow of almost any business that sells a product or service to another business. We have the same goal: to fund your business quickly and painlessly so your company can grow.

- Pay payroll on time

- Pay supplier and vendor payments on time

- Take advantage of quick pay discounts

- Pay taxes on time

- Pay bills on time

- Extend payment terms to customers that weren’t previously possible

- Fund business growth

- Credit and collections assistance (saves administrative costs)

- Buy new equipment

- Increase inventory

- New marketing initiatives

We can work fast. Most deals are funded within 2-4 days from receipt of a package and document signing. Get started today!

Get More Information

Please complete the form below. You will receive a response within 24 hours.

Sign up for our newsletter